“Avoid acting on what may appear to be unique insights that are in fact shared by millions of others.”

– Jack Bogle

Like Comparing Fresh Apples to Orange Preserves

We talks a lot around here about the benefits of diversification in an investment portfolio. When properly constructed, diversified investments can provide some insulation against severe market declines in a particular market segment, sector, or asset class. Markets are going to go up and they are going to go down, but a well thought out investment mix of various asset classes is not likely to end up at the extreme upside or downside.

It’s tempting to look at the best performing assets over the short term (such as large technology stocks most recently) and compare that to a diversified portfolio of stocks and bonds with a variety of differing characteristics. But this is apples to oranges, to use a tired cliché.

When Average is Better Than Average

A main object of diversification is to smooth out the variability of returns in a portfolio, with a resulting outcome that will not perform better than the best asset type or sector, but also one that will not underperform the worst ones. Being diversified also implies an acknowledgement that nobody can predict short term winners and losers; and that owning a piece of everything can deliver perfectly acceptable returns over the long term. Some criticize this approach as merely accepting “average” returns, but those investors who actually stay disciplined to accept those “average” returns do better than the vast majority of investors who can’t help themselves but to attempt timing exit and entry points or selecting tomorrow’s big winners.

Some criticize this approach as merely accepting “average” returns, but those investors who actually stay disciplined to accept those “average” returns do better than the vast majority of investors who can’t help themselves but to attempt timing exit and entry points or selecting tomorrow’s big winners.

But being diversified (owning everything) offers something more than just smoothing our the ride — it has another important purpose that doesn’t get a lot of attention.

Consider This:

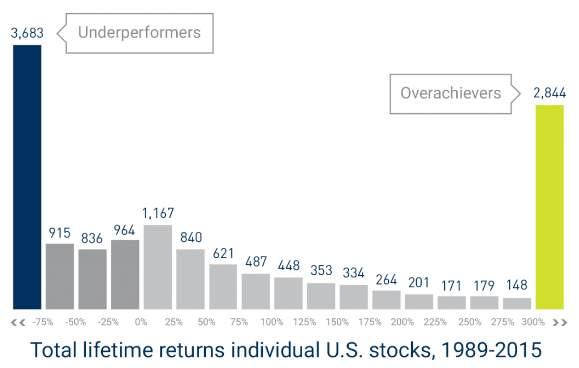

An interesting study points out that during the time period 1989 to 2015, the disparity between the winners and the losers is massive. Over 4 our of 10 stocks had a negative return for the period, while the S&P 500 increase in value by 1,200%.

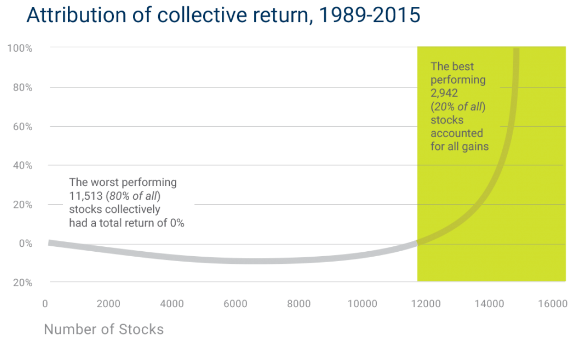

Here’s the data shown another way: 80% of all stocks had a collective return of zero. This means that just 20% of all stocks accounted for the entire market’s gain (1,200%) during this time frame.

Creative Destruction

These charts illustrate the cost of missing out on the best performers, which are such powerful drivers of overall market returns. Competition in business and markets sets creative destruction in motion, where winners win at the expense of losers.

Given this, you could try to do of either of the following:

– Buy the best performing 20%, avoid the other 80%, and outperform the average

– Own the whole market with the exception of the very worst of the worst and outperform the average

In theory, it sounds like what all investors should be doing. Many stock pickers historically have attempted to do this, or some version of this but the difficulty in persistently succeeding is enormous. So one option is to roll the dice and try to pick on the expected future winners and avoid future losers, but this is exceedingly difficult in a world where information is available everywhere and asset prices are generally reflective of the world’s future expectations. The other option is to take advantage of what diversification gives you — near certainty that you will own future winners (yes, and losers too) so that you can be in a good position to capture overall market returns, including those driven by the very best.

As always, thank you for your trust and confidence in us. Your feedback is always welcome.

Michael Traynor CFA®

Chief Investment Officer