Quote of the Quarter: “The key to fulfillment is allocation, not accumulation. What matters is not about how much time or money you have. What matters is what you do with it.”

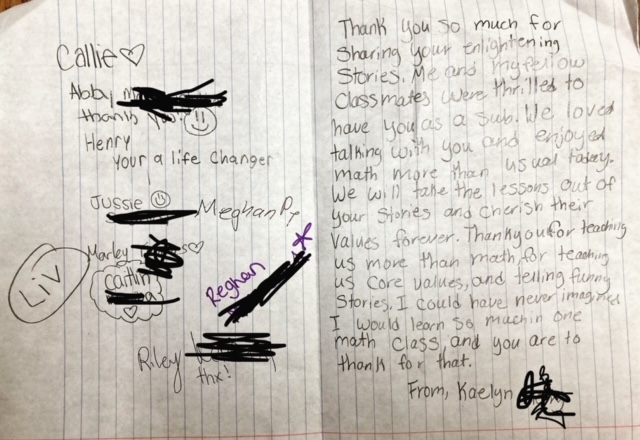

Something from our team: What’s your legacy?

This fall, we’re prepared to discuss “Legacy Plans” with our clients. Of course we review administrative items like beneficiary designations, legal documents, and insurance policies. But more importantly, we discuss the mark that these clients plan to leave on the people and causes that they care most about- both now and for generations to come.

After all, it’s not just what you “leave to” your people, but what you “leave in” your people that matters. In this month’s blog post, I share a personal story about my Pop Pop’s legacy:

October 2022: Pop Pop Bird – The Janiec Reflection (wordpress.com)

Article 1: Long-term bullish: In the article linked below, Ben Carlson writes, “My general investment philosophy is the more bearish things feel in the short run, the more bullish I should be over the long run.”

While the current environment that we’re experiencing can naturally shake anyone’s optimism and it’s nearly impossible to predict the future, it’s important to maintain perspective and remember why it’s important to stay long-term bullish.

Getting Long-Term Bullish (awealthofcommonsense.com)

Article 2: Hitting the jackpot: With the major stakes in recent lotteries, we’ve all dreamed about what we would do with the money if we hit the jackpot. However, it’s a common trend that sudden money can create more angst than fulfillment if there’s not a clear plan for handling it.

That’s not just lottery winners – that’s anyone inheriting money, selling equity in a company, or coming into a sum of money that they weren’t necessarily prepared for.

Blair Duquesnay breaks down this phenomenon and what we can do about it in the following article:

If I Had a Billion Dollars – The Belle Curve (blairbellecurve.com)

Article 3: What’s your generosity philosophy?: Discuss the following questions with yourself, a good friend, a close family member, or a trusted advisor to get your wheels turning on your generosity philosophy.

Having a clear idea of the who, what, when, where, why of your giving strategy can maximize the fulfillment of your money and your impact.

Legacy-Levers-Discussion-Starters-National-Center-for-Family-Philanthropy-and-Fidelity-Charitable-2021.pdf (ncfp.org)

Podcast Episode Recommendation:

Stephen Colbert and Anderson Cooper take a break from politics to discuss how they’ve coped with losing loved onesand what they’ve learned from grief.

Regardless of opinions on the two guys having the conversation, grief is a topic that connects all of us as humans going through this journey called life. If you’re interested, check out the podcast episode at the following link or wherever you get your podcasts:

Stephen Colbert on his ‘gratitude’ for grief’s pain | CNN

Enjoy,

Kevin Janiec, CFP® and your Financial Coach Team

This content is provided for informational purposes only and is not intended as, nor does it substitute for personalized investment advice from FC Advisory, LLC. The views and opinions expressed are those of the authors and do not necessarily reflect those of FC Advisory, LLC. Always consult the appropriate professional for questions regarding the applicability of any specific issues discussed or inferred.

The hyperlinks provided in this communication are to external websites which are owned and operated by non-affiliated third parties. If you use these hyperlinks you will leave our website; we bear no responsibility for the accuracy, legality, or content of these external sites or for that of subsequent links. No warranties or representations are being made about linked websites, the third parties they are owned and operated by, the information contained on them, the accuracy, completeness, or timeliness of their content, or the suitability or quality of any of their products or services.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk and there can be no assurance that the future performance of any specific investment, strategy, or product will be profitable, will equal any corresponding indicated historical performance levels, or be suitable for your portfolio. Due to various factors, including changing market conditions, this content may no longer be reflective of current opinions or positions.